A review of the key elements of due diligence on private equity managers and funds.

Operational due diligence is an established discipline for investors allocating to hedge funds. Operational diligence on private equity vehicles is, however, a more recent initiative, driven by two key trends.

First, institutional investors increasingly wish to implement a consistent governance, risk and compliance oversight framework over all external managers, irrespective of asset class. As such, large investors have begun to initiate similar diligence procedures with respect to PE as compared to other manager relationships (such investors also recognize the fiduciary implications of treating PE “differently” to other categories of manager).

Second, a round of SEC enforcement actions in the PE industry – including actions against several top tier firms – have sensitized investors as to the need for closer inspection of PE manager operational controls and broader business risks.

This presentation provides an overview of diligence issues which can be encountered in the PE industry. The presentation follows Castle Hall’s OpsDiligence® methodology, considering 10 core risk factors:

- Manager

- Compliance

- Information Technology

- Fund Terms and Governance

- Asset Controls

- Trading Controls

- Valuation Controls

- Reporting Controls

- Operational Due Diligence

- Transparency

Visit Castle Hall's Due Diligence University to download our Private Equity diligence primer and other resources, or contact us to learn how Castle Hall can help allocators build and implement risk-based due diligence policies and programs.

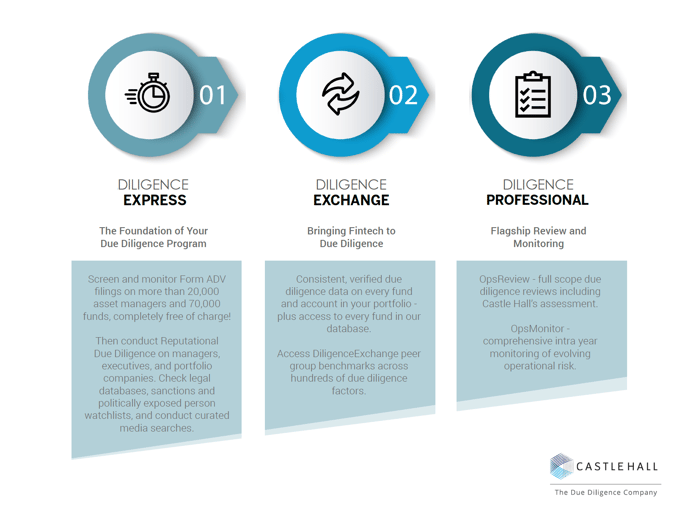

Learn more about Castle Halls 3 Steps to Effective Due Diligence.

We hope the DiligenceHub Help Center will provide quick answers to your questions as you as you begin to use the app. Please browse the articles at your convenience - and, of course, feel free to send a support ticket or live chat with our team if you have questions at any time.