Explore due diligence activities and considerations to effectively assess the ESG characteristics of asset management companies.

Environmental, Social and Governance issues have become a key due diligence priority. Global issues such as climate change, resource scarcity, income inequality, diversity and corruption have led businesses worldwide to fundamentally change corporate strategy.

Against this background, investors are transitioning to conduct more detailed due diligence on the ESG capabilities of the asset managers in their portfolios or proposed for a new allocation. Manager supplied data on ESG topics is a great start to the due diligence process, but self-reported, unverified data should clearly be subject to more thorough due diligence. In particular, investors are wary of “greenwashing”, when an asset manager exaggerates the extent of ESG integration. Distinguishing virtue signaling from a genuine commitment to sustainable investment has become a new focus to the external manager selection process.

Against this background, investors are transitioning to conduct more detailed due diligence on the ESG capabilities of the asset managers in their portfolios or proposed for a new allocation. Manager supplied data on ESG topics is a great start to the due diligence process, but self-reported, unverified data should clearly be subject to more thorough due diligence. In particular, investors are wary of “greenwashing”, when an asset manager exaggerates the extent of ESG integration. Distinguishing virtue signaling from a genuine commitment to sustainable investment has become a new focus to the external manager selection process.

Evaluating the Responsible Investment Manager incorporates 8 categories of ESG risks as a framework for comprehensive ESG analysis of the investment management company.

- ESG Investing Profile

- Environment: Policies and Procedures

- Social and Governance: Policies and Procedures

- Diversity and Inclusion: Policies

- Claims and Actions

- Vendor Management

- Gender Diversity and Inclusion: Data

- Additional Disclosures

Visit Castle Hall's Due Diligence University to download our ESG - Responsible Investment Manager whitepaper and other resources, or contact us to learn how Castle Hall can help allocators build and implement risk-based due diligence policies and programs.

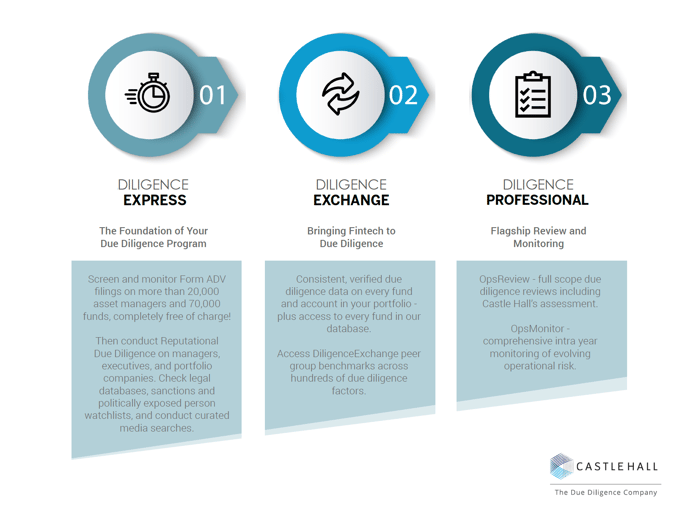

Learn more about Castle Halls 3 Steps to Effective Due Diligence.

We hope the DiligenceHub Help Center will provide quick answers to your questions as you as you begin to use the app. Please browse the articles at your convenience - and, of course, feel free to send a support ticket or live chat with our team if you have questions at any time.