Protecting an investing organization: building an effective due diligence framework

For professional investors, Operational Due Diligence (“ODD”) has become an increasingly important element of their process to allocate capital to third party asset managers.

For professional investors, Operational Due Diligence (“ODD”) has become an increasingly important element of their process to allocate capital to third party asset managers.

Internal and external stakeholders now see a DD Policy as best practice to establish a consistent, evidenced and auditable diligence process across all external manager relationships. When drafted effectively, a policy document guides daily activities, and equally provides a longer-term, strategic framework to oversee the inherent risks of a third-party manager program. Indeed, some global regulators have begun to identify ODD policies as a regulatory issue for prudentially regulated entities.

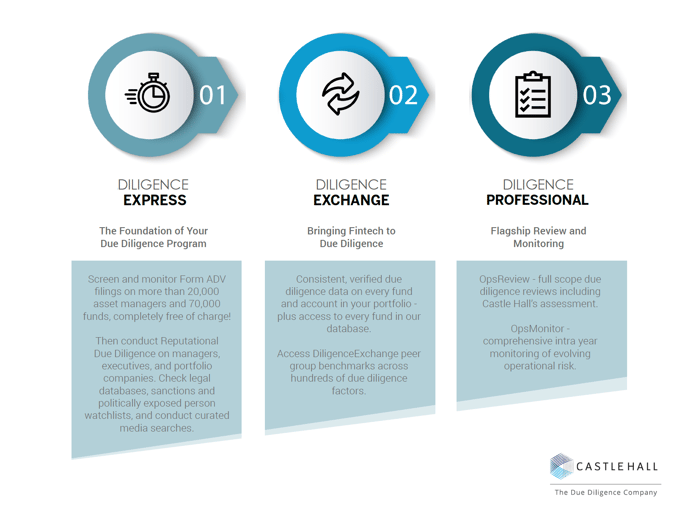

Contact us to learn more about developing a risk-based due diligence policy and how Castle Hall's 3 Steps of Effective Due Diligence provides a flexible, efficient and cost-effective solution to building and implementing a best-practice due diligence program.

We hope the DiligenceHub Help Center will provide quick answers to your questions as you as you begin to use the app. Please browse the articles at your convenience - and, of course, feel free to send a support ticket or live chat with our team if you have questions at any time.